London Session Time

19 Maggio 2021Торговые стратегии основанные на последовательности Фибоначчи

26 Maggio 2021Contents

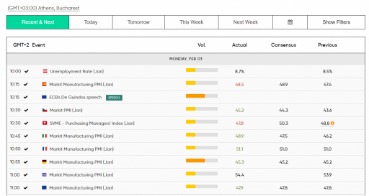

News and economic releases that hint at moving interest rates . Moves in the market are caused by vast amounts of currency being bought or sold. Specialists in the market pay attention to many different areas and ultimately make speculations over what is about to happen. This article provides general guidelines about investing topics. Ramsey Solutions is a paid, non-client promoter of participating Pros. And once you turn age 65, you can use the funds inside your HSA for non-medical expenses if you want to .

- Buyers enter bids for shares in a company and sellers issue an ask price for their assets.

- The largest companies in the world by stock market value in 2014 are 1) Apple, 2) Microsoft, 3) Exxon Mobil, and 4) Google.

- The higher a currency’s interest rate is, the more money they’ll will get.

- Indexes are a convenient way to discuss an approximation of what is happening in the market.

The two beasts are used to summarize how the overall https://en.forexbrokerslist.site/ has performed in a recent period. During periods where most stocks are rising, it is called a bull market. During periods where the market is falling or stagnant, which reflect current conditions, this is considered a bear market. Think of it like a bear hibernating for the winter and not bothering with the stock market.

WHAT IS THE FOREIGN EXCHANGE MARKET?

If you have a 401 with an employer match, start there and invest up to the match. You can automate the process of investing, helping to keep your emotions out of the process. “Anytime the market changes we have this propensity to try to pull back or to second guess our willingness to be in,” says NewLeaf’s Madsen.

But actual marketplace transactions are conducted mainly electronically these days. Stock prices are driven by the supply and demand for a company’s shares. When the demand for shares rise and outstrips the supply in the market – caused by a higher volume of – prices will likely rise. When supply increases beyond demand – due to a higher number of sellers – it can depress a share’s value. Historically, stock markets were physical locations known as pits. However, most trades now take place via electronic trading platforms, which display the best bid and ask prices available at the current moment.

It made lots of money and everyone in town loved to eat there. You had the idea to open 9 more shops around the country. With 10 total shops, you would make $800,000 a year in profit. Now, you wouldn’t walk into the Superbowl without a game plan or a big debate without a speech, and you shouldn’t start investing in the stock market without a strategy.

What is a Stock Market Exchange?

In other words, if you are a Robin Hood customer, when you submit an order, these big-shot money managers see the order before the rest of the market does. This enables them to act with market momentum before the rest of the market sees it. In most cases, these gains are merely pennies per share, but when you are doing this tens of thousands of times per second across the entire market, those pennies add up very quickly.

News shows, Hollywood films, and TV all assume that you know what the stock market is and how it works. Everyone knows that you can make a lot of money in the stock market if you know what you’re doing, but beginners don’t often understand how the market works and exactly why stocks go up and down. Here’s what you need to know about the stock market before you start investing. If a share of Microsoft is currently worth $230, who determines that? Quite simply, it is the price of the last trade that took place. On popular stocks, these prices are usually very close, often differing by a penny or two.

Even if you don’t see yourself being a very active investor, it’s still important to understand the stock market. It’s one part of an overarching financial system that affects everyday Americans. Fluctuations can impact everything from your job stability to your retirement accounts.

A stock exchange is a marketplace platform where investors and traders exchange shares of stock also known as equity securities. It’s a hub, a community place where investors, traders, and stockbrokers are connected. Anyone can purchase stock and make trades with the assistance of a stockbroker and brokerage account. Robo-advisors use algorithms to invest in the stock market for you. You’ll likely fill out an online questionnaire regarding your income, assets, risk tolerance, investment timeline, financial goals and more. The platform then automatically makes investments on your behalf, usually in funds that hold a variety of assets.

Why Companies Issue Shares

That’s in part because some fund choices can essentially give you exposure to hundreds of underlying investments in one fell swoop, potentially providing easy diversification. They also may help cut down on trading costs but be sure to always review a fund prospectus before investing. Only shares of publicly-traded companies are available to trade on the stock market. So, before buyers and sellers can trade or invest, a private company must first release its shares into the market – this is known as a primary market. Once the shares have been sold by the company, they’re then free to be traded between market participants, in what’s known as the secondary market.

7.Early https://forex-trend.net/day depends on the timing of the submission of the payment file from the payer and fraud prevention restrictions. Funds are generally available on the day the payment file is received, up to 2 days earlier than the scheduled payment date. Actual marketplace transactions are conducted mainly electronically these days. Activate your 30 day free trial to unlock unlimited reading.

Equities are the same as common stock, and large volume trading occurs with common stock. Since it trades more, the value of common stock is higher than the preferred shares. Beside it, you’ll see the figure to the right on the same line which represents the outstanding shares. Detailed company search instructions are provided on the SEC website.

So, you—and maybe millions of others—have a bit of a say in operations , as well as a vested interest in the https://topforexnews.org/’s performance. There are a number of factors that can affect a stock’s price but in the most general sense, when the company does well in terms of revenues and profits, the value of your shares may go up. But if the company performs poorly, the share price may drop. Note that you’ll also be able to find the average volume of shares traded on a company’s website. Click on the investor relations link typically found on the homepage.

How Stock Prices are Set

In general, how a company begins to sell on the open market is that divides ownership into shares which are collectively called stock or equity. That company then has the right to go public and sell its shares on the stock market. The stock market allows retail investors to buy and sell company shares. Although it’s not mandatory, a public company can pay dividends to shareholders who purchase preferred shares. (More on this later in this guide.) Dividends are special perks that shareholders get in the form of stock or cash. The potential returns from the stock market tend to be higher than interest from the bank.

Motley Fool Investing Philosophy

The P/E Ratio formula allows you to plug in the known information to get as close to as possible to accurate stock value. In addition, the fundamental analysis and technical analysis are two ways stocks are processed to determine share values. A dual-class structure is a stock where the founders, executives, and possibly family members can purchase a small quantity of stock yet have a higher percentage of voting rights. For instance, Class A shares may have 20 votes per share, Class B just one vote, Class C, no voting rights, while others may be given a dual-class structure. There may be stipulations on the voting rights of those who hold common shares. A company can assign shares differently to indicate the level of voting privileges.

The priority for stock exchanges is to protect investors through the establishment of rules that promote ethics and equality. Examples of such SROs in the U.S. include individual stock exchanges, as well as the National Association of Securities Dealers and the Financial Industry Regulatory Authority . The NYSE and Nasdaq are the two largest exchanges in the world, based on the total market capitalization of all the companies listed on the exchange. Unlike other financial markets, such as the stock market or specific commodity markets, currencies are not traded on a central exchange. Instead, it’s a highly decentralised market, which allows a huge number and variety of people to access it, to buy currencies or swap one currency against another.